Saving as a way of life

When you’re just trying to make ends meet, it may seem impossible to save. But no matter how much or how little money you have, there are ways to make saving a way of life and create a secure financial future for yourself and your family.

Recognise the control you have over saving and spending

Both you and your family will have more motivation to save when you see that you really do have control over your expenses. Recognising the extent of your financial control will allow you to make decisions that can help you improve your financial situation both now and in the future. For example, you can decide to reduce your family’s credit card spending. This is something you and your family can control. When you see that you’re making progress towards paying off your debt, acknowledge and celebrate your successes together. Agree on something fun you can look forward to once the debts are paid off, such as saving for a family holiday.

Make saving a habit

Adopting a money-saving lifestyle means developing money-saving habits, not just temporary choices. Here are some steps you can take to make it easier to make smart spending decisions now and into the future:

Set limits. Saving money isn’t about giving up all the things you enjoy. It’s about enjoying them in moderation. If you spend a lot of money on books, renting movies, or downloading music, you could limit yourself to paying for just one such item a month. Borrow the rest from friends or from the library.

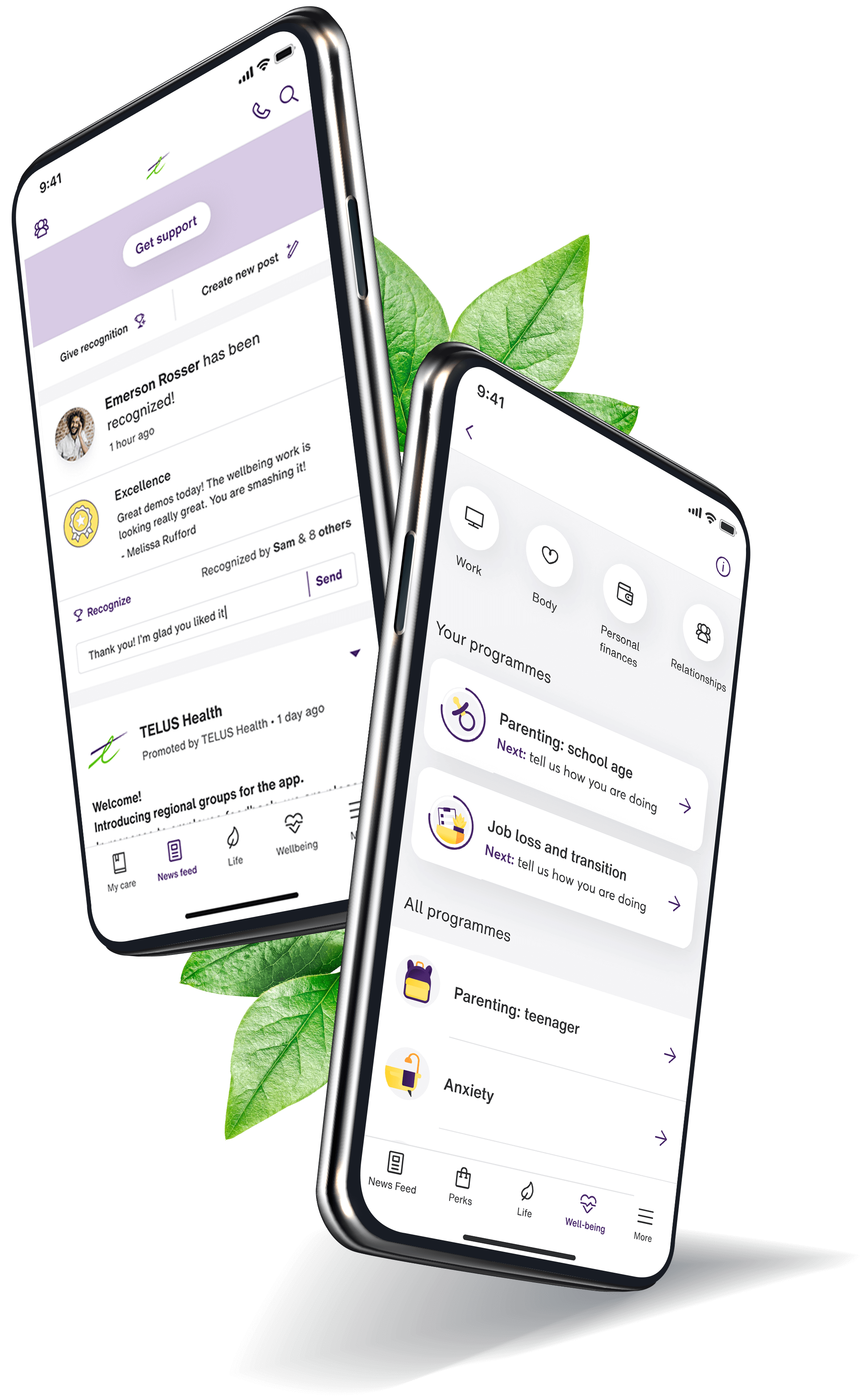

Develop a budget-management system that works for you. For expenses that easily get out of hand, such as eating out, groceries, and entertainment, consider using cash envelopes to physically set aside the money you’ve budgeted for those expenses each week or month. Download a personal finance app to help you stay on track.

Establish some money-saving rules. For example, turn off the lights when leaving a room and the computer when leaving the house; make shopping lists and stick to them; and instead of discarding unwanted items, sell them for a little extra cash. Also, set aside a certain percentage of your income for paying off debts and reaching your financial goals.

Look for better deals on the things you buy or use every day. For example, try generic (or own brand) products, food, and generic medicines instead of brand names. Take advantage of sales and “buy one, get one free” deals. And review competing offers from other providers when service contracts come up for renewal, especially on things like your mobile phone or WI-FI. When you’re evaluating a deal for ongoing services, beware of limited-time promotional prices. Make sure the long-term charges will be less than what you are currently paying.

Make your credit cards less accessible. Leave them at home or ask a trusted family member to hold them for you. Consider cancelling credit cards you don’t need but do it gradually and slowly so that you don’t dramatically affect your credit score by reducing your available credit too quickly.

Use coupons and make it easy to remember to use them. Keep restaurant coupons with takeaway menus and store printed supermarket coupons near your shopping list or weekly menu plans. Make it a habit to regularly check digital coupons on your supermarket’s app.

Learn how to maintain and repair your home, car, and clothing. Fixing things yourself costs less than replacing them or paying someone else to do the work. Ask a friend or neighbour to help if you aren’t sure how to fix something. You’re also likely to find a “how-to” video on almost any kind of repair online.

Think “free.” Some of the best things in life really are free. Visit the library, explore a park, go camping in your garden, or go for a walk on the beach. Instead of going to the cinema, consider rotational hosting of game or DVD nights with friends or family, or have a potluck instead of going out for dinner.

Make one-time changes for ongoing savings

Many one-time changes can save you money month after month:

Get rid of services you don’t need. Are you paying for a streaming service that you rarely use? Do you pay for a land line when you only use your mobile? Review your service contracts and stop paying for anything you don’t use.

Bundle your services. Many companies offer bundled Internet, phone, and cable or satellite services for a cheaper price than you would pay for them individually. But again, beware of limited-time promotional prices - make sure the long-term charges will continue to save you money.

Lower your insurance premiums. Consider increasing your excess or using just one insurance company to reap the benefits of a multiple-policy discount. Shop around when a policy comes up for renewal to make sure you can’t find a better deal elsewhere.

Make your home more energy efficient. Homeowners can find ways to save energy at International Energy Agency.

Set up automatic bill payments. You’ll save on late fees. Monitor your bank statement and bills for errors on automatic payments, and remember to record the payments in your budget.

Take advantage of employer-sponsored saving opportunities. Check with your human resources department to find out what benefits may be available.

Start saving for your retirement as soon as you can. Whether you have an employer plan or your own individual retirement savings account, set up regular contributions. Take advantage of compound interest—the interest you earn each year that is added onto your principle. The longer your money has to accrue compound interest, the higher your balance will be when you retire.

Reevaluate your spending choices regularly

While you may want to stick with a spending plan that currently allows you to save, remember to review your plan regularly and make adjustments to reflect your changing needs. Here are some tips to help:

Prioritise what’s important. If you have a family, talk to them about what’s important, and make sure your spending and saving habits reflect the things you value most. Your family may be willing to take a shorter holiday so that you have money left over for another family event. They may be willing to skip starters when you eat out so that you can go to restaurants more often.

Continue to differentiate between your needs and wants. Something that seemed like a necessity before may be a luxury you can cut back on now. For example, paying for a cleaner may have once felt like a necessity, but now that money is tight, it may be a luxury you can do without.

Reevaluate your options. For example, if you have children and you use a childcare provider, are they still the most cost-effective solution for your family’s needs? Or is there a cheaper option, such as paying for childcare for part of the week and accepting your relative’s offer to care for your child two days a week?

Enjoy the benefits of saving more and spending less

The benefits of saving more and spending less are many:

Having control over your finances. For many, it’s a relief to rein in the spending and return to basics. It feels good to have control over such an important part of your life.

Appreciating occasional luxuries. Luxuries and treats often lose their appeal as they become everyday items. Cutting back allows us to experience them as the special treats they were designed to be. A luxury doesn’t have to be expensive; it can be as simple as an afternoon cinema trip or a coffee at a new cafe.

Spending time with family. Studies show that family is very important to people around the world, and spending time together as a family can be inexpensive and priceless.

Being prepared financially for an emergency. Global economic pressures and rising interest rates have resulted in many people understanding the importance of building emergency savings. Learn from the experience and protect your financial wellbeing by building up your emergency fund to equal three to six months of living expenses. Having cash reserves can provide you with peace of mind and help reduce financial stress.

Appreciating what you have. Especially in uncertain economic times, having a sense of gratitude for what you have lessens the desire for more things that you don’t need, which can help deter overspending.

Keeping up your saving habits even in an improving economy will allow you to make the most of your money in the years to come. You’ll look back and be grateful you adopted saving as a way of life.