Understanding and improving your money mindset

Save plenty, spend wisely, and invest the rest: the basics of personal finance are simple. But implementing them can be complex, even if you’ve grasped the mechanics. That’s because money can be very emotional. The feelings you have about money and the narrative you tell yourself about how it works are sometimes called your money mindset.

What is a money mindset and why is it important?

Your money mindset is made up of your core values, beliefs, and narratives around money. These beliefs are often subconscious, but they steer your money decisions. So, coming to grips with yours is essential in order to understand what’s motivating your decisions.

How is your money mindset created?

Many of our core beliefs about money are formed when we’re children. Whether they are positive or negative, they usually come from our parents and other caregivers, and our wider community.

Consider the following scenarios:

- If you grew up in a family where your parents spent recklessly and were always struggling financially, or where you heard disparaging comments about wealthy people, you may have negative associations with earning, saving, or investing money.

- If you grew up in a household where money was never spoken about, you may feel like discussing money with a spouse or partner, asking for a raise, or talking about your income is impolite.

- If you grew up with material comfort and saw your parents discuss money matters calmly and without judgment, you may be more likely to have a positive relationship with money now.

Examples of common money narratives

There are endless variations of money mindset narratives that people may hold. Some of them may be negative or limiting, preventing you from creating the money mindset that serves you best.

Here are some examples of limiting money narratives:

- I’m not good with money.

- Rich people are selfish and shallow.

- I can either make money or do a job I love, but not both.

- Money is there to spend—you can’t take it with you.

- Money isn’t important to me.

- Money is the root of all evil.

- My family has always struggled with money.

- I’ll never make enough money to retire so there’s no point in saving.

- The money I have makes me superior to others who have less.

- I’ll never get out of debt.

- Money is confusing.

There are also positive money narratives. Here are some examples of empowering money narratives:

- I understand all my financial obligations and can meet them without feeling stress.

- I plan my spending and saving well.

- Money is one of the tools I use to live the life I want.

- I don’t have to be a millionaire to be wealthy.

- I have achievable financial goals and a plan to reach them.

- My retirement savings are on track for a comfortable future.

- My debt is under control.

Do any of these sound familiar to you? Consider writing down your own list of positive and negative money narratives, thinking about the kinds of money lessons you learned from parents and other adults when you were a child. You may discover some beliefs that are subtly affecting how you feel about things like wealth, investment, debt, earning, and saving.

How do you shift your money mindset?

Once you start to understand your money mindset, you may decide that you want to work to improve elements of it. For example, if you feel like money is risky and confusing, it might lead you to avoid making investments, even if investing would likely benefit your financial situation. Or you might notice that you believe money corrupts, so you may subconsciously sabotage your own bank balance by overspending each month.

Money mindsets work in many ways that might be hard to detect. Once you learn what yours is, you can start to notice how it influences your decisions or behaviour in a way that’s holding you back from reaching your goals. At these moments, it’s good to exercise mindfulness, recognising that you’re being directed by your emotions rather than logic, for example.

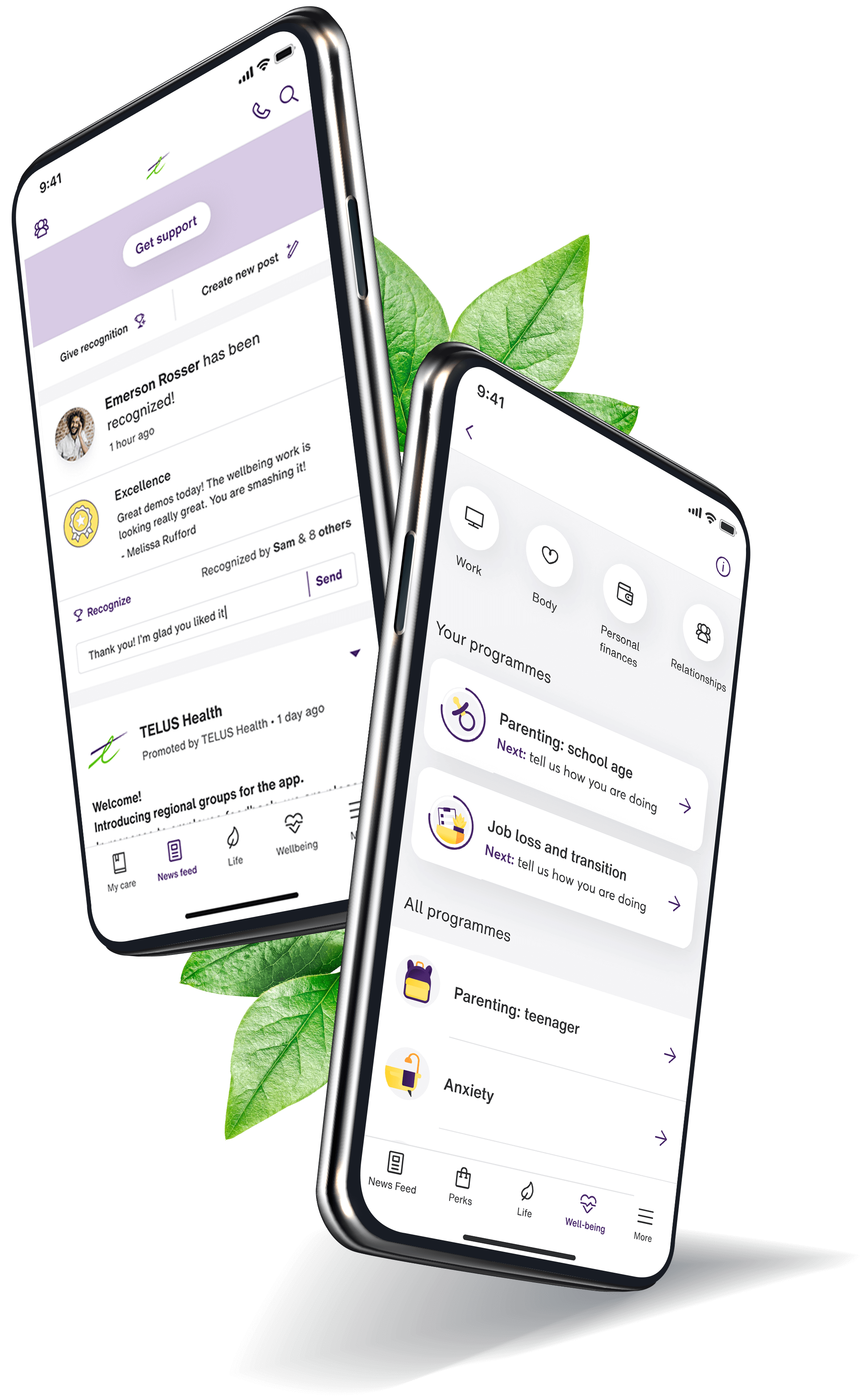

You may decide to talk to a financial advisor who can help give you good guidance and help with emotion-free decision-making. If money matters are causing you stress, you can speak to a counsellor via your assistance programme to discuss your feelings and uncover some of your underlying money beliefs so you can start addressing them.